If you’re serious about your business, you need to know if your marketing campaigns are working. And one way to do that is by tracking your Customer Acquisition Cost (CAC). It’s a critical metric that tells you how much it costs to win over a new customer.

In marketing and advertising, CAC refers to the costs incurred by a business to acquire a new customer.

At Boosterberg, we’re on a mission to help businesses like yours reduce their CAC on social media. But before we dive into how to lower your CAC, let’s first explore what it is and why it matters.

By understanding the ins and outs of this metric, you’ll be better equipped to optimize your Facebook ad campaigns and get more bang for your buck. So keep reading to learn how to lower your CAC and achieve more efficient results from your Facebook advertising efforts.

The challenge of measuring CAC in the digital world

The truth is, promoting your business through digital channels is getting more expensive by the year. In fact, a recent report by SimplicityDX, published in 2022, reveals that rising CAC is now a major challenge for brands and retailers worldwide.

According to the report, merchants in 2013 lost an average of $9 for every new customer they acquired. Fast forward to 2022, and that number has skyrocketed by 222%, now totaling a whopping $29 per customer.

Jordan Jewell, a former research director at IDC and current analyst in residence for VTEX, confirms that CAC has become a significant hurdle for retailers and brands alike. For SimplicityDX, Jewell highlights that “rising customer acquisition costs are one of the top challenges facing retailers today.” So if you’re feeling the pressure to lower your CAC, know that you’re not alone.

Customer acquisition cost is a massive challenge for brands and retailers. Some brands now find it cheaper to acquire new customers by delivering personalized paper catalogs to their homes rather than acquiring them via digital advertising. This would have been unthinkable just a few years ago when marketing through digital channels was a bargain.

Social media is a key customer acquisition channel

When it comes to digital channels, Jordan Jewell notes that social media is especially challenging to measure CAC accurately. And he’s not wrong.

Take Facebook, for example. With over 2.8 billion monthly active users, the social media giant is a popular platform for businesses seeking new customers. But while Facebook offers advanced targeting options and a vast audience, measuring CAC can be a real headache.

In fact, a more recent report by SimplicityDX highlights that social media is a crucial customer acquisition channel for many brands. However, the report also reveals that social commerce revenue is typically underreported by about 245%.

Why is that? According to the report, many customers skip clicking through the social media site and purchase directly from the brand’s e-commerce site instead. As a result, most analytics packages fail to track the sale, and social revenue is mistakenly recorded as “direct revenue.” This discrepancy can significantly impact measuring CAC for social media marketing campaigns, making it even more critical to find ways to lower your CAC and maximize your ROI.

Gerry Widmer, co-founder and chief executive officer of SimplicityDX, commented,

Brand marketers spend on average 25% of their digital budgets on social media but cannot accurately measure its impact. This research suggests that CAC is dramatically lower and ROAS significantly higher for social campaigns than previously thought.

This is why understanding the CAC is imperative for businesses looking to maximize their return on investment and grow their customer base.

What makes CAC?

Calculating CAC involves adding up all the costs associated with acquiring a new customer and dividing that total by the number of new customers acquired during a specific period. As we mentioned earlier, the factors that influence CAC include:

- Advertising costs – the amount a business spends on advertising channels like Facebook.

- Conversion rates – the percentage of people who take desired actions after clicking on an ad, such as purchasing or signing up for something.

- Customer lifetime value – the lifetime revenue a customer generates for a business.

To calculate CAC, you need to add up all the costs associated with acquiring new customers, including the following marketing strategy components:

- Advertising costs: This includes the money spent on advertising channels like Facebook ads, Google AdWords, or sponsored content.

- Creative costs: These are the costs associated with creating marketing and advertising content, including graphic design and copywriting.

- Campaign management costs: This includes any fees paid to third parties to manage marketing campaigns, including social media management and email marketing.

- Salaries and overhead: This refers to the cost of salaries, benefits, and overhead associated with marketing and advertising.

- Technology costs: This includes the costs of marketing automation software, analytics tools, and other technology platforms used to track marketing campaigns.

Calculating your Customer Acquisition Cost

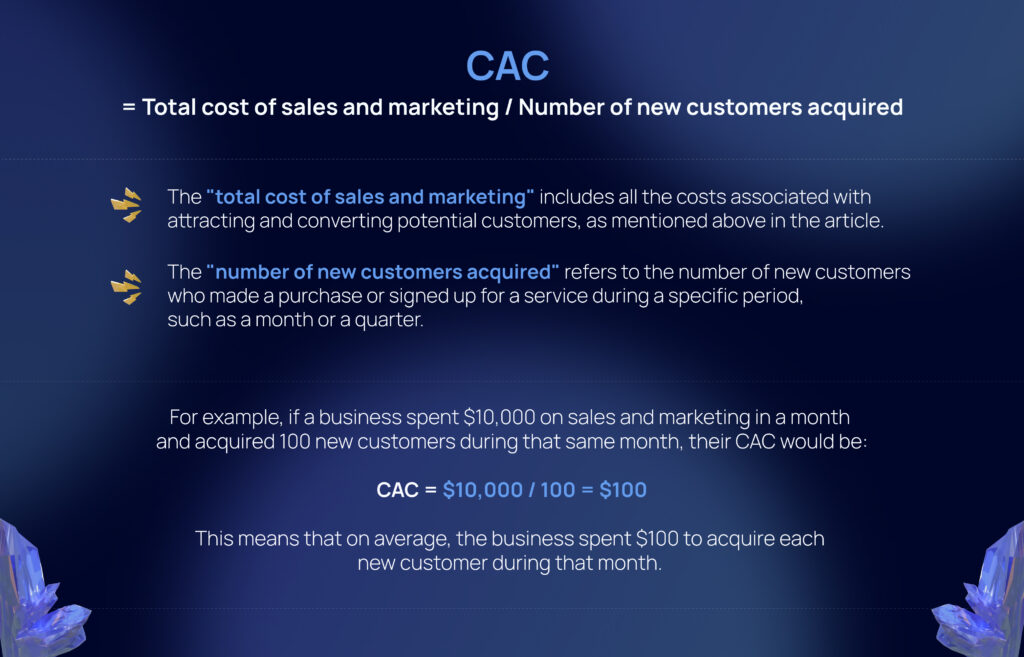

Once you have calculated the total costs, you can divide that number by the number of new customers acquired during the specific period following a simple formula:

CAC = Total cost of sales and marketing / Number of new customers acquired

- The “total cost of sales and marketing” includes all the costs associated with attracting and converting potential customers, as mentioned above in the article.

- The “number of new customers acquired” refers to the number of new customers who made a purchase or signed up for a service during a specific period, such as a month or a quarter.

For example, if a business spent $10,000 on sales and marketing in a month and acquired 100 new customers during that same month, their CAC would be:

CAC = $10,000 / 100 = $100

This means that, on average, the business spent $100 to acquire each new customer during that month.

Customer Acquisition Costs Using Facebook Ads

Facebook has an enormous user base, with over 2.9 billion active users as of 2021, making it a prime platform for businesses to acquire new customers. With advanced targeting options that allow for precision targeting based on demographics, interests, behaviors, and locations, Facebook Ads can be an effective tool for customer acquisition.

But let’s talk money. While there’s no magic number for the average CAC on Facebook, as it varies depending on factors such as industry, target audience, ad format, and bidding strategy, there are industry reports that offer insights into average CACs.

For instance, WordStream’s 2021 study found that the average CAC for Facebook ads across all industries was $31.09, with the apparel industry having the lowest average CAC of $7.63 and the legal industry the highest at $123.29.

However, it’s crucial to note that CAC is not the be-all and end-all of customer acquisition. The quality of leads generated by ads and the customer lifetime value (CLV) they bring also significantly influence CAC. For example, a high-quality lead generating significant revenue over time may justify a higher CAC, while a low-quality lead that generates little revenue may make a lower CAC unsustainable. Therefore, businesses must focus on both minimizing CAC and maximizing their customers’ CLV.

How to lower your Facebook CAC

The best way to reduce customer acquisition cost (CAC) in Facebook ads is to combine effective targeting, compelling ad creative, and ongoing testing and optimization.

Below are some tips to reduce your customer acqusition cost:

Optimize targeting:

Reaching the right audience via Facebook ads is a good way to reduce CAC. Facebook targeting options, including interests, behaviors, and lookalike audiences, allow you to identify your ideal customers and tailor your ads accordingly.

Example:

A fitness apparel company used Facebook’s lookalike audience targeting to reach potential customers similar to its existing customers. They were able to reduce their CAC by 38% as a result.

Invest in engaging ad creative:

High-quality advertising can attract potential customers and spur them to take action. Use eye-catching visuals, clear and concise messaging, and compelling calls-to-action (CTAs) to encourage clicks and conversions.

Example:

A cosmetics company created a video ad campaign featuring customer testimonials highlighting the benefits of their product instead of just posting photos of their products. This resulted in a 60% reduction in CAC.

Experiment with different ad formats and placements:

You can identify what works best for your target audience and campaign goals by testing different ad formats, such as video, carousel, or collection ads.

Example:

An e-commerce retailer tested different ad formats and found that video ads performed better than image ads. Their CAC decreased by 52% after they started using video ads more.

Monitor ad performance and optimize it regularly:

Measure it regularly and adjust as needed to improve ROI. Adjust targeting, ad creatives, and bidding strategies to optimize conversions.

Example:

A software company reviewed its Facebook ad campaigns regularly and found retargeting ads generated the highest conversions. They reduced their CAC by 30% by focusing on retargeting.

Focus on high-quality leads:

Cutting CAC is important, but the objective should also be to generate high-quality leads with a higher conversion rate and customer lifetime value (CLV).

Example:

If you sell high-end luxury watches, you might want to target customers with a high income and a demonstrated interest in luxury products. Creating targeted Facebook ads that speak to this specific audience and directing them to a landing page with a clear value proposition can help you attract and convert higher-quality leads with higher CLVs.

Increase customer retention:

Retaining existing customers is always cheaper than acquiring new ones. Through excellent customer service, loyalty programs, and personalized offers, focus on building good relationships with current customers.

Example:

A subscription-based meal delivery service may want to retain existing customers through excellent customer service, personalized offers, and loyalty programs. They can increase customer satisfaction and reduce churn by offering discounts for repeat orders or creating exclusive content for loyal customers, ultimately lowering the need to acquire new customers.

How to lower your CAC using automated ads

If you want to lower your customer acquisition cost, but you’re still doing tasks manually that could be automated, it’s time to stop and take advantage of the many benefits that automation can bring. Including reducing your customer acquisition costs.

One powerful tool that you can use to automate your Facebook ad campaigns is AI-powered ad optimization software like Boosterberg. By analyzing ad performance and making changes to bidding strategies, ad placements, and targeting options in real-time, these tools can help you enhance ad performance and increase conversions while lowering their CAC.

These tools can help you:

- Optimize ad campaigns

- Monitor and adjust campaigns based on performance data

- Avoid overspending on campaigns that are not delivering results

Automated ad optimization is a game-changer if you’re looking to reduce your customer acquisition cost. By using AI-powered algorithms to optimize campaigns in real-time, you can ensure that you are spending your ad budgets efficiently and ultimately lowering their CAC, allowing you to focus on other important aspects of your business.

Don’t let manual post boosting hold you back from achieving your advertising goals. Contact us today and discover how Boosterberg can help you automate your ad campaigns and reduce your CAC.

Would you like to learn more about

Boosterberg’s Ad Presets?